Executive Summary:

- The Risk: Most CFOs focus entirely on the Entry Tariff (e.g., ₹3.65) but ignore the Exit Clauses.

- The Cost: A weak Termination Clause can lock you into a failing project for 15 years, turning a “cheap” tariff into a liability.

- The Solution: Negotiate the “Divorce” before the Marriage.

- The 3 Must-Haves: Defined Exit Conditions, Change in Law Protection, and Specific Liquidated Damages.

The ₹50 Crore Clause: Why I Stopped a Gujarat Steel Giant from Signing a ₹3.65 PPA

Last month, the CFO of a massive steel manufacturing plant in Gujarat called me. He was sitting on a PPA (Power Purchase Agreement) offer for a Solar-Wind Hybrid solution.

The offer looked perfect on the surface:

- Tariff: ₹3.65/unit (Market competitive).

- Term: 15-25 Years.

- Savings: Projected to save Crores annually.

He asked me, “Gaurav, the numbers look good. Should I sign?”

I told him to put the pen down.

I asked him a question that usually makes decision-makers uncomfortable: “You are about to enter a 15-year marriage. Have you negotiated the divorce?”

He was perplexed. “Why talk about separation before the relationship even begins?”

Here is the brutal truth I shared with him, and the truth every CEO and CFO needs to hear before signing a renewable energy contract.

The “Entry” is Easy. The “Exit” is What Kills You.

In the world of corporate renewable energy, Tariff is Vanity. A low tariff (like ₹3.65) is often the “bait” used to trap you in a weak contract.

If you sign a long-term agreement based solely on the entry price, you are not buying an asset; you are buying a liability.

The moment the market shifts, regulations change, or the project delays, that “cheap” power becomes the most expensive mistake on your balance sheet.

We audited his contract using our internal framework. We found that while the Price was good, the Protection was zero.

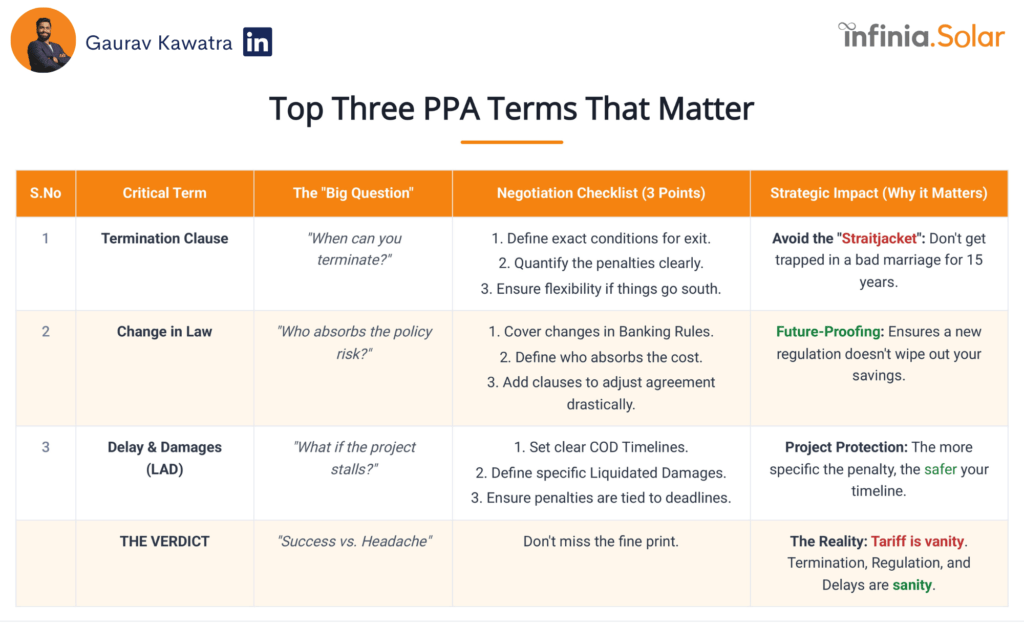

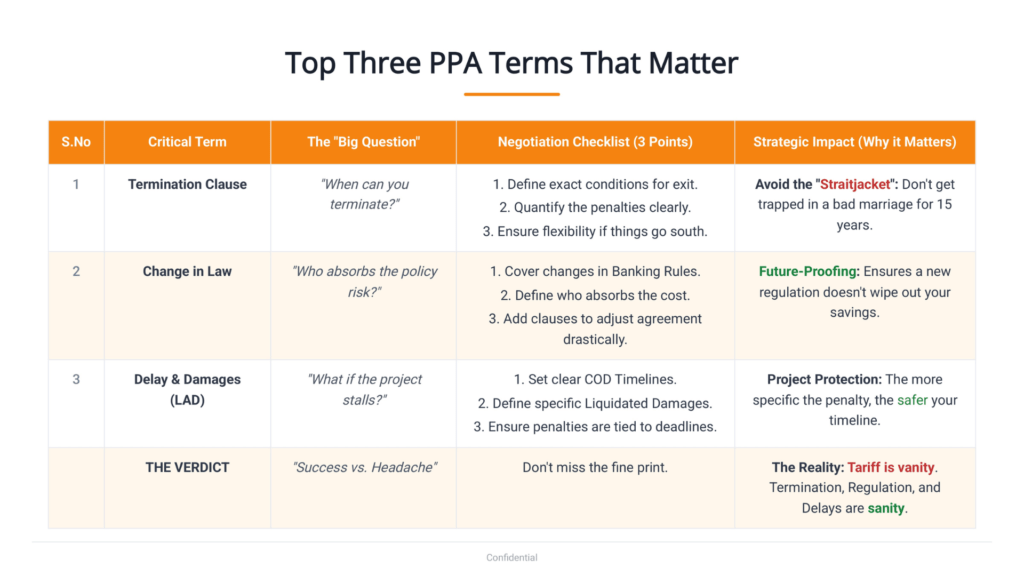

Here are the Top 3 Clauses (The “Divorce Terms”) we forced the developer to renegotiate before we allowed the client to sign.

1. The Termination Clause (The Divorce)

Most standard PPAs are designed to be what we call a “Straitjacket.” They make it financially impossible for you to leave, even if the developer fails to perform.

The Trap: The contract was vague on exit terms. It did not clearly define when the buyer could leave or what the penalty would be.

- Translation: You risk getting trapped in a bad marriage for 15 years with no clear way out.

The Fix: We restructured the clause to ensure flexibility.

- Define Conditions: We clearly defined the exact conditions (like chronic underperformance) that allow the buyer to exit.

- Quantify Penalties: We ensured that if an exit happens, the penalties are clearly quantified upfront, removing the ambiguity that developers often use to block an exit.

Boardroom Insight:

- Big Question: “When can you terminate?”

- Strategy: Don’t just ask for an exit; define the exact cost of the divorce before you sign the marriage certificate.

2. Change in Law (The Protection)

Renewable energy policies in India are volatile. Banking rules change. Grid charges fluctuate.

The Trap: The original draft left the buyer exposed to regulatory shifts.

- Translation: If a new government regulation adds a cost next year, your savings could be wiped out while the developer stays protected.

The Fix: We added a “Future-Proofing” layer.

- Cover Banking Rules: We ensured the clause covered changes in Banking Rules, not just tax laws.

- Absorb the Cost: We clearly defined who absorbs specific costs. We added clauses to adjust the agreement drastically if a policy shift makes the project unviable for the buyer.

Boardroom Insight:

- Big Question: “Who absorbs the policy risk?”

- Strategy: Ensure a new regulation doesn’t turn your asset into a liability.

3. Delay & Damages (The Accountability)

Time is money. Every month the project is delayed is a month of lost savings.

The Trap: The contract promised a Commercial Operation Date (COD) but lacked teeth.

- Translation: If the project stalls, the developer loses nothing, but you lose months of planned savings.

The Fix: We inserted “Project Protection” mechanics.

- Clear Timelines: We set rigid COD timelines that were not open to interpretation.

- Specific Liquidated Damages (LDs): We ensured penalties were tied to specific deadlines. If the developer misses the date, they pay specific damages to cover your loss.

Boardroom Insight:

- Big Question: “What if the project stalls?”

- Strategy: The more specific the penalty, the safer your timeline.

The Verdict: Tariff is Vanity. Sanity is the Contract.

The CFO didn’t just sign a PPA at ₹3.65. He signed a contract that guaranteed accountability, protected against policy risk, and allowed a clean exit.

My advice to you: When you sit across the table from a developer, stop looking at the tariff for a moment. Look at the “Divorce Terms.”

If they aren’t willing to discuss the Exit, you shouldn’t be discussing the Entry.

Need a Second Opinion on your PPA?

If you are currently negotiating a PPA and need an expert Open Access Renewable Energy Consultant to review your terms, do not sign blindly.

About Infinia Solar

Infinia Solar is India’s leading renewable energy consultant.

We help Commercial and Industrial consumers procure the right renewable energy solutions, from the right developers, and on the right PPA terms.

We’ve served 60+ customers across 18 states, enabling 1.3 GW of open access and rooftop solar capacity, and have facilitated 150+ PPAs so far.

This has helped our customers reduce up to 50% of their electricity costs and replace up to 100% of their power with renewable energy.

We have also collaborated with 50+ developers, and our customers fondly refer to us as the ‘Amazon of the renewable energy industry.‘